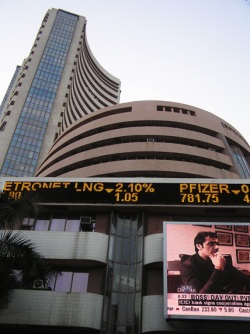

Where the indian stock market is headed?

Posted by sspventure on September 17, 2009

Currently the Indian Stock market is hitting new highs every day. BSE SENSEX is trying to touch 17000 and NSE NIFTY moving towards 5000 marks.

From March 2009 the Indian market has continuously raised and gained around 90% from the March lows. This was pretty much due to the below reasons

1) Increased liquidity in the Overall Global Markets

2) Improving Economic situation of the global economies

3) Majority Congress Government after recent India Elections

4) Better Q12010 results by the Indian corporate

Due to all these reasons above and also the improvement in the rain in India, the Indian markets are roaring to reach the new heights. Now the market players are betting on the good Q2 results from the Indian corporate. If the results come in line with the expectation of the market then definitely we can see further up move of 10 to 20 percents from these levels. And also if the results don’t come as per the market expectations there will be definite down move.

Somehow to me it looks like the market has run beyond its fundamentals and currently the valuations are very expensive. Any major negative news can spoil the market sentiments and drag it down by 10-20% from these levels. Leaders all over the world are taking necessary steps to keep the momentum going. The money pumped by the different governments in the economy is fueling the stock markets. Due to the excess money in the market everybody is trying to cash-in on the increasing markets which in turn accelerating the pace of the index growth.

The worldwide fundamental issues like the unemployment, housing rates, Industrial growth rate, are not improving as the market is expecting it to be. The Indian market has run much beyond the current fundamentals of the market and the overall economic situation in the world. Any bad news from US or china can disturb the sentiments very badly. Different corporate are also trying to cash-in on the improved sentiments of the market. They are coming up with IPOs with stretched valuations, getting funds by QIPs, coming up with the follow-on public offers, rights issues, direct sale of the shares to the Institutional investors etc. India’s biggest private sector player RIL has also sold some treasury shares at an average price of Rs. 2125 accumulating an amount of US $664.

Selling of stocks by the promoters to raise the money is kind of alarming situation and the retail investors need to be very cautious here on. The market is consolidating and moving upwards on any slight positive news from US, or any other part of the world. Also there have been lot of emphasize given on the local growth or domestic growth story for India. It is pretty clear that India as a country has tremendous potential for growth but the markets are running much beyond the fundamentals.

Considering the overall situation it looks like the Indian Market will keep up moving till the Q2 results in hope of better results from the cooperates. But there is major chance of a big correction in the range of 10-20 percent in the very near future. Any bad news from US banks, China bubbles, and Swine flu influence can start the downward movement for the market.

Rahul said

The is likely waiting for a correction. I don’t understand why there is such a mad rush to enter the stocks eventhough they are higly overvalued…

Rahul…

sspventure said

Sir,Thanks for your comment.

-SSPVenture Admin