Background and Business activities

Pipavav Shipyard is shipbuilding and repair facility, co-owned by SKIL Infrastructure Ltd. and Punj Lloyd Ltd. and also counts Singapore’s Sembcorp Marine Ltd. among its stakeholders.

Pipavav Logo

Pipavav Shipyard currently has not commenced commercial operations and is engaged in building the Pipavav Shipyard located on the west coast of India adjacent to major sea lanes between the Persian Gulf and Asia.

After the construction of the shipyard is complete Pipavav would be able to construct and repair ships and vessels of various sizes and construction of products like offshore rigs, jackets and vessels for oil and gas companies. Pipavav right now has agreements in place for the construction of 26 Panamax bulk carriers with the capacity of 74,500 DWT each for delivery from 2009 to 2012.

Pipavav Shipyard picture

Price Band and issue dates

Price band – Rs. 55 to Rs 60 a share

Dates – Between 16th September 2009 and 18th September 2009

Size – 8.55 Crore Shares (Rs 470 – 513 Crore)

Objectives of the Issue

Construction of facilities for ship building, Ship Repair

To meet the working capital requirements

Key Risks

Possibility of Order book contraction

Current Order Book US $930mn.However recently there has been a sharp fall in the prices of steel plates (constituting 20% of overall cost) leading to substantial reduction in the construction cost of ships. Against this backdrop, Pipavav’s clients have demanded a discount in the billing rates which will impact Margins as well as Revenue visibility going ahead

Risk of Execution delays

Pipavav will become fully operational post April 2010 even though commercial operations commenced from April 2009. The company will deliver its first vessel post April 2010 with subsequent deliveries expected at intervals of one to three months thereafter. We expect the company to start booking Revenues FY2010 onwards instead of following the % completion method as only the trial runs have begun till FY2009. Further, the government subsidy, which is historically delayed, constitutes lion’s share (60%) of our FY2011E PBT. Our Earnings estimates would be hit in case of execution delays.

Peer Analysis and Suggestion

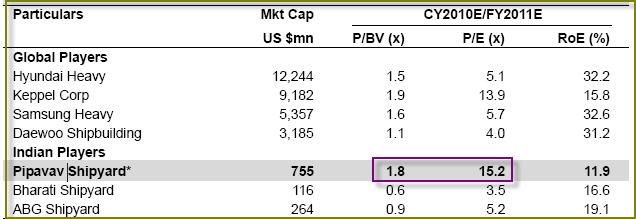

Pipavav peer analysis

Pipavav’s issue has been factored in company’s strong Order inflow, potential extension of the government subsidy and timely execution. Considering the global and domestic players in the industry the issue looks really expensive. We are suggesting to AVOID the subscription for this issue.